RCPA Member Request: Sign Onto RCPA Letter and Reinforce the Urgency to End the Budget Impasse

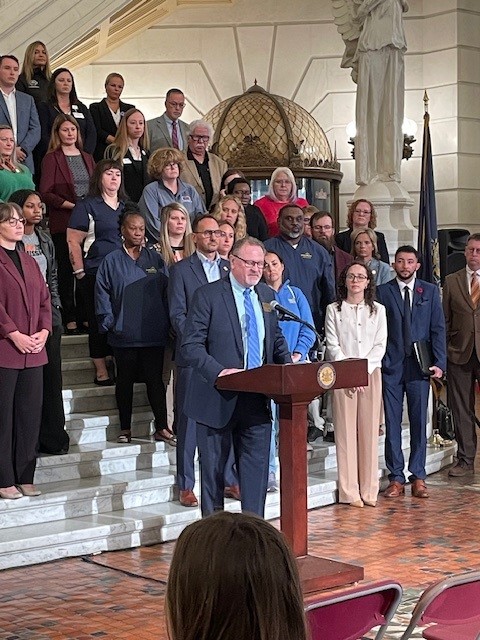

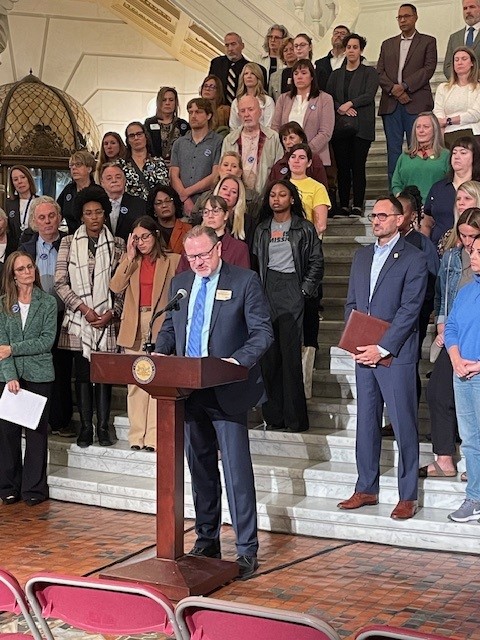

RCPA Joins The Coalition of Critical Services Providers at Harrisburg Rally to Urge Passing of State Budget

On Thursday, October 2, RCPA joined The Coalition of Critical Services Providers at the Harrisburg State Capitol Rotunda, urging Governor Shapiro and the Pennsylvania General Assembly to pass a final state budget that invests appropriately in health and human services before there are no providers left to care for Pennsylvania’s most vulnerable. The event served as a call for an immediate budget resolution to ensure vital services for residents can continue across the Commonwealth as the Pennsylvania budget impasse enters its fourth month. Speakers included RCPA COO and Mental Health Policy Director Jim Sharp and President from United Way of PA Kristen Rotz. Behavioral Health Division Policy Associate Emma Sharp and Government Affairs Director Jack Phillips were also in attendance.

|

—– |  |

|

—– |  |

In addition, RCPA member EIPA Vice President Anne Lang and RCPA member Pathways Forward CEO Pat Slattery spoke of the current challenges in funding, stressing that investing money now would be vastly more economical than the long-term cost of leaving services underfunded.

|

—– |  |

Richard Edley and Jackie Donahue Interviewed on Good Day PA! Regarding State Budget Impasse

RCPA and Chimes Holcomb are joining other nonprofits in Pennsylvania to share challenges that the lack of an approved state budget is causing for our organizations and the vulnerable people we support. Richard Edley, President and CEO of RCPA, joined Jackie Donahue from RCPA member Chimes Holcomb on WHTM27’s Good Day PA! program, to emphasize how nonprofits across the state are struggling, and the dire need for the budget impasse to end in PA.

RCPA Shares Information on Impacts of Federal Government Shutdown

Join Us for a Press Conference Thursday, Oct. 2 on State Budget Impasse and Its Effects

RCPA has joined The Coalition of Critical Services Providers in urging Governor Shapiro and the Pennsylvania General Assembly to pass a final state budget that invests appropriately in health and human services before there are no providers left to care for Pennsylvania’s most vulnerable. To support this effort, The Coalition will be holding a press conference on Thursday, October 2, at 9:00 am in the Capitol Rotunda in Harrisburg. The event will feature speakers calling for an immediate budget resolution to ensure vital services for residents can continue across the Commonwealth, as the Pennsylvania budget impasse enters its fourth month. Among the speakers will be RCPA staff and members, along with other Coalition members and organizations.

The Coalition recently surveyed organizations representing all 67 counties in Pennsylvania. The survey found the ongoing Pennsylvania state budget impasse is having profound, real-world impacts on children, families, older adults, and service provider employees, as counties and organizations struggle to provide services due to lack of funding. The prolonged budget standoff further threatens the security and well-being of Pennsylvanians as we enter October. The Coalition will share the survey findings and impact information shortly.

RCPA strongly encourages our members to take part in the event this Thursday in Harrisburg. If you plan on attending, please contact RCPA COO and Mental Health Services Director Jim Sharp. Additional details and information will be communicated to members. You can also view RCPA President/CEO Richard Edley’s Letter to the Editor in PennLive, for more details on the impacts of the budget impasse.

WHO: Coalition Members, RCPA Members, Advocates, Stakeholders

WHEN: Thursday, October 2, 2025, 9:00 am – 10:00 am

WHERE: Harrisburg State Capitol Rotunda, 501 N 3rd Street, Harrisburg, PA 17120

About the Coalition

The Coalition includes providers from for-profit, nonprofit, and county agencies dedicated to delivering critical services throughout the Commonwealth. The members include: Community Action Association of Pennsylvania; Feeding PA; Hunger-Free PA; Pennsylvania Association of Area Agencies on Aging; Pennsylvania Association of Nonprofit Associations; Pennsylvania Council of Children, Youth and Family Services; Pennsylvania State Alliance of YMCAs; Pennsylvania Head Start Association; Pennsylvania Association for the Education of Young Children; Pennsylvania Coalition to Advance Respect; and Rehabilitation and Community Providers Association.

Pennsylvania’s Most Vulnerable Can’t Wait Any Longer for a Budget Deal | PennLive Letter to the Editor by Richard Edley

RCPA Sends Letter to the Governor and General Assembly Regarding the Budget Impasse

ANCOR and RCPA Provide Details on How Federal Government Shutdown Would Affect Human Services Providers

Last week, the US House of Representatives passed a continuing resolution (CR) to keep the government funded through November 21, 2025. However, the CR legislation was not passed in the US Senate, failing with a vote of 44–48. The House and Senate have now adjourned for recess this week without finding a path forward to keep the government funded past September 30, 2025.

Although there are ongoing discussions among Republican and Democratic leaders, the Senate is not currently slated to return to Washington until September 29, and the House may not return until October. If an agreement on funding legislation is not reached by September 30, there will be a government shutdown.

To help prepare for what a government shutdown could mean, we are providing a helpful resource from McDermott+.

Below are key takeaways from how a shutdown could impact human services providers:

- Depending on the length of a shutdown, Medicaid will continue to have sufficient funding and state payments so that providers should not be interrupted. A shutdown that extends beyond the quarter could potentially result in delayed payments to states, although that is unlikely.

- It is likely that a percentage of HHS staff, including CMS, will be furloughed for the length of the shutdown, although the current administration has yet to release new guidance regarding agency procedures. With limited staff, CMS is unlikely to approve state plan amendments and waivers during a government shutdown, although review may occur in the background.

- During a shutdown, the Administration for Community Living has historically continued activities funded through carryover funding.

- SAMHSA has historically continued substance abuse and mental health programs during previous shutdowns, including those that provide critical behavioral health resources in the event of a natural or human-caused disaster, such as disaster behavioral health response teams, the disaster distress helpline that provides crisis counseling to people experiencing emotional distress after a disaster, and the 988 lifeline to connect people in crisis with life-saving resources.

- The current Medicare telehealth flexibilities are extended via statute. However, the statutory provision expires on September 30, and needs to be extended by legislation (not regulation); these flexibilities would end if a government shutdown occurs. Pre-pandemic limitations for Medicare telehealth coverage and payment would return. These include waivers to geographic and originating site restrictions, expansions to the list of eligible practitioners, authorization of telehealth via audio-only telecommunications, use of telehealth for required face-to-face encounters prior to hospice care recertification, and the delayed in-person visit requirement for tele-mental health service.

- A shutdown could impact the regulatory process. For example, if there were pending rulemaking, the Centers for Medicare and Medicaid Services (CMS) staff who work on these rules, along with the Office of Management and Budget (OMB) staff who review the regulations before they are released, could be furloughed in the event of a shutdown.

- In the event of a government shutdown, Medicare and Medicaid payments to states do not immediately stop if the federal government shuts down. Both Medicaid and Medicare are mandatory spending programs, which means their funding is authorized permanently, and is not subject to the annual appropriations process that lapses.

These are all assumptions based on prior history, but shutdown operations under the new Trump administration could look quite different from how they have previously operated.

For additional information on other health care programs, please see this document.