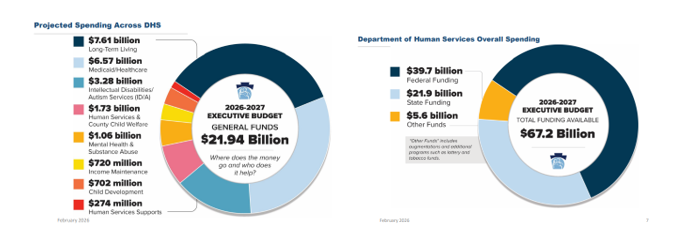

On Friday, February 6, Department of Human Services (DHS) Secretary Val Arkoosh presented an overview of Governor Shapiro’s proposed Fiscal Year (FY) 2026/27 budget and detailed the projected spending across DHS, which totals $21.94 billion in state funding. The Secretary highlighted that all three Medicaid managed care programs, as well as waiver programs for people with intellectual disabilities and autism, are receiving increases, largely driven by patient needs and costs associated with delivering care. The proposed FY 2026/27 budget includes $39.7 billion in federal funding as well as $5.6 billion from augmentations and additional programs, such as lottery and tobacco funds, making the total DHS funding $67.2 billion.

The Secretary expressed how the proposed budget reflects the direct impacts of HR 1, with significant federal funding at risk. The distribution for the 2026/27 budget is based upon the current structure of Medicaid and other federally funded programs, but the Secretary noted that beginning in 2028, changes in Medicaid financing rules will remove $20 billion from Pennsylvania’s Medicaid program over the following decade.

Budget Highlights and Investments

- Investments in Health:

- Food is Medicine: $900,000 (federalizes to $2.3 million) in state funds to launch a pilot program that will provide nutritionally appropriate food to improve quality of life and health outcomes while lowering overall health care costs for Medicaid recipients with significant health care needs.

- Housing Stability: $1 million in state funds (federalizes to $2.5 million) to launch a pilot that will connect people experiencing homelessness to stable housing and services that improve health and care management.

- Reentry Supports: $900,000 in state funds (federalizes to $2.7 million) to provide pre-release coverage (up to 90 days prior to release from a State Correctional Institution) for substance use care and intensive case management.

- Continuing ODP Multi-Year Growth Strategy: Building upon Shapiro’s 2024 multi-year strategy to expand access to home and community-based services and effectively end the emergency waiting list of adults with intellectual disabilities with autism, the proposed budget allots $30 million in state funds, which federalizes to $66.2 million. This will allow for 850 more people to be served in the Community Living Waiver and 400 more people to be served in the Consolidated Waiver.

- Supporting 988 Call Centers and Crisis Services: The proposed budget includes a $10 million investment in the crisis response workforce to help 988 call centers, as well as $5 million in state funds to continue prior year commitments for emergency behavioral walk-in centers.

- Sustaining Early Intervention Rate Increase: The Secretary stated that the EI line item in the executive budget reflects the changing state cost to run the program and not an anticipated cut in funding. The release of the DHS Blue Book will have more information about the total funding with federal match. DHS intends to keep the new, updated rates from the 2025/26 budget, and revised rates will be released soon.

- County Base Mental Health Services Funding: RCPA has confirmed that there will be no allocation increase for county base funding. While previous budgets had included $20 million for county base mental health funding, it was not included in the 2025/26 budget or the proposed 2026/27 budget.

Due to technical difficulties, DHS was unable to record the webinar, but the presentation slides and transcript can both be viewed.

Please contact your RCPA Policy Director with any questions or concerns.