We invite you to attend an RCPA regional meeting in your area on any of the below dates in August or September 2022. The meetings will focus on RCPA issues, including:

- Legislative information;

- Division and conference updates;

- Department of Human Services (DHS) updates; and

- Status of the CCBHC/ICWC program in PA.

We will also provide an update to the addiction treatment community on our advocacy efforts to ensure the Opioid Use Disorder Centers of Excellence transition from a DHS-directed payment model to a state plan service is fair and manageable for providers. In addition, ProVantaCare (our sister managed care entity) will review its efforts, goals, and upcoming opportunities.

Immediately following lunch, we invite RCPA members and advocates to participate in the Delta Center Convening on Telehealth. RCPA has collaborated with National Council on bringing together primary care associations (PCAs) and behavioral health state associations (BHSAs) to advance policy, payment, and practice changes that will benefit the millions of people served by health centers and community behavioral health organizations (CBHOs). RCPA is the recipient of grant funds through the Delta Center to cultivate health policy and a care system that is more equitable and better meets the needs of individuals and families.

In this forum, we will engage in roundtable discussions with consumers and practitioners on their opinions on the effectiveness, challenges, and future use of telehealth to deliver behavioral health services. The information gathered will guide the PA Delta Center team in its advocacy for developing regulations, bulletins, and practices that ensure equity and access to services for all communities. Your participation will be key to our ongoing work in establishing a healthy and sustainable telehealth footprint in Pennsylvania. For additional information, please contact Jim Sharp, Director, Children’s Division.

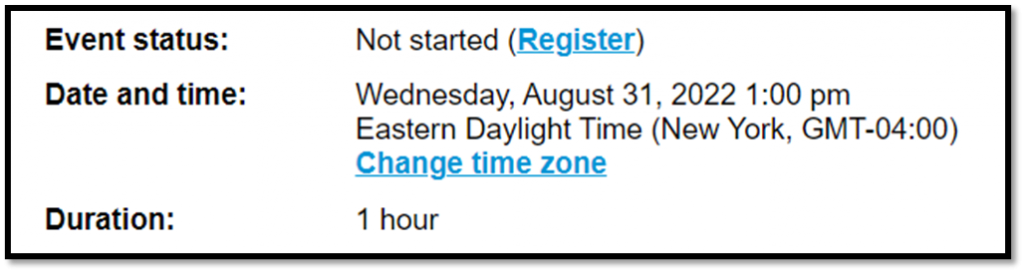

Please see the full agenda here. Registration is required.

Monday, August 1 — RCPA Central Regional Meeting and Delta Center Telehealth Convening

Sheraton Harrisburg Hershey Hotel, 4650 Lindle Road, Harrisburg, PA 17111

Register Here

Tuesday, August 2 — RCPA NE Regional Meeting and Delta Center Telehealth Convening

Holiday Inn Wilkes Barre, 600 Wildflower Drive, Wilkes-Barre, PA 18702

Register Here

Friday, August 19 — RCPA Western Regional Meeting and Delta Center Telehealth Convening

RLA Learning and Conference Center, 850 Cranberry Woods Drive, Cranberry Township, PA 16066

Register Here

Friday, September 16 — RCPA SE Regional Meeting and Delta Center Telehealth Convening

The Alloy King of Prussia, a DoubleTree by Hilton, 301 W. Dekalb Pike, King of Prussia, PA 19406

Register Here